Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Ummeed Housing Finance raises Rs. 36 crore in Series B

Ummeed Housing Finance, a Delhi-based affordable housing finance company, has raised about Rs. 36 crore ($5.6 million) in a Series B round from existing investors Lok Capital Growth Fund and Duane Park. It had raised about Rs. 22 crore ($3.5 million) in the first round of institutional funding from these two investors in October 2016.

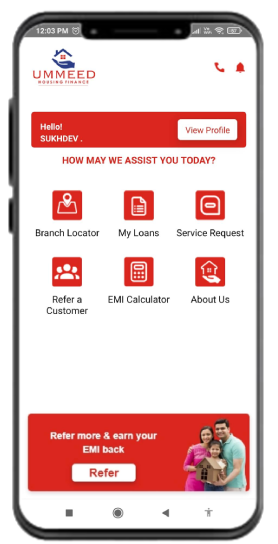

According to a press release, Ummeed will use the funds raised now to expand in North and Central India, invest in SMAC (Social, Mobile, Analytics and Cloud) technologies and grow assets under management by six times this year.

Ummeed focusses on providing housing finance access to families with low and informal income. Over the last eight months, it has grown with three branches in Delhi, Chandigarh and Jaipur and has close to Rs. 20 crore of assets under management. The company aims to expand to six new locations in North and Central India and increase assets under management to Rs. 120 crore by March 2018.

The company offers home loans ranging from Rs. 3-25 lakh for purchasing apartments, constructing homes, improving existing homes and for loans against property.

Ashutosh Sharma, who founded Ummeed in January 2016 after working for nearly 25 years in various multinational banks, was quoted in the release as saying that the fresh round of investment comes at a time when the company is ready to scale. “We will strengthen our fintech and move towards becoming a mobile platform,” he was quoted in the release. Ummeed plans to build scoring modules that can improve operation efficiencies, reduce turnaround time and build robustness around the credit quality of the portfolio.

Ummeed, which has built a technology platform for loan origination and management, targets to go paper-less, using tablets in all its branches to study customers, run algorithms for credit scoring and disburse loans quicker, according to the release.

One of the sectors that impact investor Lok Capital invests in is financial inclusion, of which affordable housing finance is a critical part.

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Lok Capital, Duane Park invest $3.5 million in Ummeed Housing Finance

Mumbai: Ummeed, a Delhi-based housing finance company focused on affordable housing in north and central India, has raised $3.5 million in a Series A round of funding from impact investor Lok Capital and Duane Park.

This is the maiden investment from Lok’s third fund—Growth Catalyst Partners—which achieved its first close of $40.5 million in June. Lok Capital’s investment in Ummeed is the third investment in this sector by the investor, following earlier investments in Aptus and SEWA Grih Rin.

Vishal Mehta, co-founder and partner at Lok Capital, and Anurag Bhargava of Duane Park will join the board of Ummeed.

The institutional funding will fuel Ummeed’s expansion plans as well as boost the deployment of technology towards achieving greater operating efficiency.

Founded in January 2016 by Ashutosh Sharma, a seasoned banker with over 25 years of experience at Citigroup Inc., HSBC Holdings Plc. and Bank of Montreal, Ummeed focuses on providing housing finance access to families with low, informal income.

The operating team consists of professionals with extensive small-ticket mortgage experience at AU Housing, Magma FinCorp Ltd and Shubham Housing Development Finance Co. Pvt. Ltd.

Ummeed’s focus is on affordable housing finance loans in the range of Rs3-25 lakh, Sharma said.

“We are focussing on people with informal incomes. If you look at many of the banks and the larger NBFCs, they find it easier to dole out loans to people with salaries and people who have formal incomes and tax records. But in our country, almost 90% of the population does not fall into that category. Therefore, the market we are targeting is quite huge and underserved," he said.

According to Sharma, the company will follow a hub model instead of having several smaller branches in various micro-markets.

“We believe that you can serve multiple micro-markets through a hub. With the right technology such as a mobility platform, tech for faster credit scoring, you can efficiently serve a 30 to 50 kilometer radius without having to repeat brick and mortar," said Sharma.

The company, which received its licence from the National Housing Bank (NHB) in July, recently started operations with its first hub in East Delhi and plans to have 11 such hubs operating across north and central India, targeting 1500 customers in the next 12 months.

“Our aspiration is to create a significant business in the next five years across north and central India, which could be 25-30 hubs," said Sharma.

The immediate next hubs will be opened in Chandigarh and Jaipur, said Sharma, adding that by end of the current financial year, the company will have around four operating hubs.

With a strength of seven to 10 people per hub, they can each generate assets of around Rs.25-30 crore on a full-year basis, said Sharma.

The affordable housing finance space has been witnessing a lot of interest, not just from impact focused investors but also traditional private equity funds.

Last week, Mint reported that Morgan Stanley Private Equity was in talks with Jerry Rao’s affordable housing finance company Home First Finance Co.

In August, Mint reported that Delhi-based Shubham Housing Development Finance Co. Pvt. Ltd was looking to raise around $100 million from PE funds.

In February, Kedaara Capital and Partners Group acquired the housing finance business of small-finance-bank licensee Au Financiers for around $140 million.

According to a report by research house ICRA, the total outstanding housing credit in India as on 31 March 2016 stood at around Rs12.5 trillion, against Rs10.5 trillion as on 31 March 2015—an annualized growth of 19%.

Within overall housing credit, the affordable housing segment for housing finance companies grew at a fast pace.

As per ICRA’s estimates, the total loan book of all players in the affordable housing segment stood at Rs95,700 crore as on 31 March 2016, indicating a growth of 28% during the year. New players in the affordable finance space nearly doubled their portfolio to Rs14,000 crore.

“Opportunities for growth are high for the segment given the current low penetration levels as well as the government thrust on the affordable housing segment. Overall, ICRA believes that the affordable housing segment offers good growth potential and could report reasonable returns over the long term," the report said.

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Ummeed Housing Finance raises $3.5 mn from Lok Capital, Duane Park

Delhi-based Ummeed Housing Finance Pvt. Ltd has raised $3.5 million (around Rs 23.4 crore) in a Series A round of funding from impact investor Lok Capital and Duane Park.

The affordable housing finance company focused on north and central India will use the funding to expand and invest on technology to enhance operating efficiency, it said in a statement.

Ummeed aims to differentiate itself by leveraging technology, including going paperless and using tablets—which can help study customers, run algorithms for credit scoring and disburse loans at a faster pace—at branches.

Vishal Mehta, co-founder and partner at Lok Capital, and Anurag Bhargava of Duane Park will join the board of Ummeed. Alok Prasad, former CEO of Microfinance Industry Association (MFIN), will also join as a non-executive board member.

Ashutosh Sharma, Founder & MD, Ummeed Housing

Ashutosh Sharma, Founder & MD, Ummeed Housing

Finance

Founded in January 2016 by Ashutosh Sharma, a banker with over 25 years of experience at Citibank, HSBC and Bank of Montreal, Ummeed focuses on providing housing finance access to families with low, informal income.

The company is backed by a team of former Citibank professionals, who have experience in commercial banking, credit and mortgage.

Sachin Grover, chief operating officer, has over 20 years of mortgage experience at Citi Financials, IIFL and Magma Housing. The operating team consists of professionals with mortgage experience at Magma, AU Housing Finance and Shubham Housing Development Finance Company.

“The company targets families that have semi-formal or informal incomes and comprise the bottom-of-the-pyramid, remain largely under-served by housing finance companies and banks for loans below Rs 10 lakh, making them dependent on local money lenders,” said Sharma.

The firm is currently operational in east Delhi and plans to have 11 branches across north and central India, targeting 1,500 customers in 12 months.

Lok Capital

This is Lok Capital’s maiden investment from its third fund Growth Catalyst Partners (GCP), and the third investment in this sector, following earlier investments in Aptus Value Housing Finance and SEWA Grih Rin. In 2015, SEWA Group raised equity funding of Rs 13.5 crore ($2.15 million) from a consortium of investors, including Lok Capital for its housing finance company SEWA Grih Rin Ltd.

Housing finance firms

Several housing finance companies have been looking to grow business and loan portfolios by consolidating their market share in the affordable housing segment. These firms have seen keen interest from private equity players.

Recently, North-focused Shubham Housing Development Finance Company Pvt. Ltd has started a process to raise its fourth round of Rs 265 crore in private funding, as the Gurgaon-based mortgage lender looks to meet demand for small-ticket loans and grow its balance sheet.

Last month, Chennai-based Aptus Value Housing Finance raised Rs 270 crore in a follow-up round from WestBridge Capital Partners LLC and Caspian Impact Investment Advisors.

In July, Carlyle-backed PNB Housing Finance Ltd filed its draft red herring prospectus for an initial public offering to raise up to Rs 2,500 crore.

Mortgage lender HomeFirst Finance Company too is reportedly looking for funding.

The potential of the Indian affordable housing finance segment is pegged at Rs 8.8 trillion (around $135 billion), according to a Monitor-Deloitte study commissioned by World Bank and the National Housing Bank. However, the portfolio of existing affordable housing players is only Rs 6,500 crore (around $1 billion).

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Lok Capital-led fund invests $3.5 million in Ummeed Housing Finance

NEW DELHI: Lok Capital-led fund has invested $3.5 million (nearly 23 crore) in Delhi-based Ummeed Housing Finance, which will use the funds for expansion.

"This is the maiden investment from Lok's third fund. Duane Park is a co-investor in this investment round," Lok Capital said in a statement.

The institutional funding will fuel Ummeed's expansion plans as well as boost deployment of technology towards achieving greater operating efficiency, it added.

"The funding from Lok and Duane Park will help us bolster our technology platform and accelerate our expansion plans," said Ashutosh Sharma, founder, Ummeed.

Vishal Mehta, co-founder and Partner, Lok Advisory Services, said that while there is a large unaddressed market in affordable housing finance, "to make a significant impact and build an efficient, scalable model and depth of reach is key".

Ummeed's approach to marketing with a hub-spoke strategy and a conscious focus to build a technology-savvy company will allow this, he said.

Ummeed offers customised home loans, ranging from Rs 3 lakh to Rs 25 lakh, to suit customer requirements, including purchase of apartments, construction, home improvements and extensions and availing loans against property.

Lok manages three funds with over $125 million under management.

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Lok Capital-led fund invests $3.5 mn in Ummeed Housing Fin

Lok Capital-led fund has invested $3.5 million (nearly 23 crore) in Delhi-based Ummeed Housing Finance, which will use the funds for expansion.

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Lok Capital-led fund invests USD 3.5 mn in Ummeed Housing Fin

New Delhi, Oct 17 (PTI) Lok Capital-led fund has invested USD 3.5 million (nearly 23 crore) in Delhi-based Ummeed Housing Finance, which will use the funds for expansion. "This is the maiden investment from Loks third fund. Duane Park is a co-investor in this investment round," Lok Capital said in a statement. The institutional funding will fuel Ummeeds expansion plans as well as boost deployment of technology towards achieving greater operating efficiency, it added. "The funding from Lok and Duane Park will help us bolster our technology platform and accelerate our expansion plans," said Ashutosh Sharma, founder, Ummeed. Vishal Mehta, co-founder and Partner, Lok Advisory Services, said that while there is a large unaddressed market in affordable housing finance, "to make a significant impact and build an efficient, scalable model and depth of reach is key". Ummeeds approach to marketing with a hub-spoke strategy and a conscious focus to build a technology-savvy company will allow this, he said. Ummeed offers customised home loans, ranging from Rs 3 lakh to Rs 25 lakh, to suit customer requirements, including purchase of apartments, construction, home improvements and extensions and availing loans against property. Lok manages three funds with over USD 125 million under management. PTI NKD ARD

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Lok Capital-led fund invests USD 3.5 mn in Ummeed Housing Fin

Lok Capital-led fund has invested USD 3.5 million (nearly 23 crore) in Delhi-based Ummeed Housing Finance, which will use the funds for expansion.

"This is the maiden investment from Lok's third fund. Duane Park is a co-investor in this investment round," Lok Capital said in a statement.

The institutional funding will fuel Ummeed's expansion plans as well as boost deployment of technology towards achieving greater operating efficiency, it added.

"The funding from Lok and Duane Park will help us bolster our technology platform and accelerate our expansion plans," said Ashutosh Sharma, founder, Ummeed.

Vishal Mehta, co-founder and Partner, Lok Advisory Services, said that while there is a large unaddressed market in affordable housing finance, "to make a significant impact and build an efficient, scalable model and depth of reach is key".

Ummeed's approach to marketing with a hub-spoke strategy and a conscious focus to build a technology-savvy company will allow this, he said.

Ummeed offers customised home loans, ranging from Rs 3 lakh to Rs 25 lakh, to suit customer requirements, including purchase of apartments, construction, home improvements and extensions and availing loans against property.

Lok manages three funds with over USD 125 million under management.

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Lok Capital invests $3.5 million in Ummeed Housing

BENGALURU:Lok Capital has led a funding round of $3.5 million in Ummeed, a Delhi-based Housing Finance company focused on affordable housing in North and Central India. This is the maiden investment from Lok’s third fund. Delhi-based private company, Duane Park also participated in this round.

The institutional funding will be used to expand as well as boost deployment of technology towards greater operating efficiency. Vishal Mehta, Co-founder & Partner, Lok Advisory Services and Anurag Bhargava of Duane Park will join the board of Ummeed.

The potential of the Indian housing finance segment is pegged at $135 billion, according to a Monitor-Deloitte study. However, the portfolio of existing affordable housing players is only $1 billion.

Founded in January 2016 by Ashutosh Sharma, who has over 25 years of experience working at Citi, HSBC and Bank of Montreal, Ummeed focuses on providing housing finance access to families with low, informal income. The company is backed by a team of ex-Citibank professionals. The operating team consists of professionals with extensive small-ticket mortgage experience at AU Housing, Magma.

“Families that have semi-formal or informal incomes and comprise the bottom-of-the-pyramid, remain largely under-served by housing finance companies and banks. This is especially true when the loan requirement falls below Rs 10 lakhs, making them highly dependent on local money lenders. We want to change this by offering an easier, more reliable option for loans,” said Ashutosh Sharma, founder, Ummeed.

The company is currently operational in East-Delhi and plans to have 11 branches operating across North and Central India. It said it is targeting 1500 customers in the next 12 months.

While there is a large unaddressed market in affordable housing finance, to make a significant impact and build an efficient, scalable model, depth of reach is key, ” said Vishal Mehta, co-founder and partner at Lok Advisory Service.

This is Lok Capital’s third investment in this sector. It had earlier invested in affordable housing finance group Aptus and self-employed woman association group, SEWA Grih Rin.

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Lok Capital, Duane Park invest US$3.5mn Series A funding in Ummeed Housing Finance

Lok Capital advised Growth Catalyst Partners (GCP)– the third fund from the India focused impact investor - today announced that it has led the Series A investment of USD 3.5 mn in Ummeed, a Delhi-based Housing Finance company focused on affordable housing in North and Central India. This is the maiden investment from Lok’s third fund.

Duane Park is a co-investor in this investment round. The institutional funding will fuel Ummeed’s expansion plans as well as boost deployment of technology towards achieving greater operating efficiency. Vishal Mehta, Cofounder & Partner, Lok Advisory Services and Anurag Bhargava of Duane Park will join the Board of Ummeed.

Alok Prasad, Ex-Mortgage Head at Citi Financials and Ex-CEO of Microfinance Industry Association (MFIN), will also join as a Non-Executive Board Member at Ummeed.

The potential of the Indian affordable housing finance segment is pegged at INR 8.8 trillion (~$135 bn), according to a Monitor-Deloitte study commissioned by World Bank and the National Housing Bank. However, the portfolio of existing affordable housing players is only INR 6,500 Crore (~$1 bn). As banks and large NBFCs focus towards the formal, higher income segment, an immense opportunity presents itself for startups like Ummeed to develop a sustainable business model in lending to the informal market.

Founded in January 2016 by Ashutosh Sharma, a seasoned banker with over 25 years of experience at Citi, HSBC and Bank of Montreal, Ummeed focuses on providing housing finance access to families with low, informal income. The company is backed by a team of ex Citi Bank professionals, who have solid foothold in commercial banking, credit and mortgage. Sachin Grover, the Chief Operating Officer, has over 20 years of mortgage experience at Citi Financials, IIFL and Magma Housing. The operating team consists of professionals with extensive small-ticket mortgage experience at AU Housing, Magma and Shubham.

While companies in the affordable housing space are largely traditional brick and mortar players, Ummeed aims to differentiate itself by leveraging technology to operate its business on ground. Its in-house technology team is building a robust technology platform for loan origination and loan management. Ummeed aims to go paperless, deploying tablets in all of its branches that can study the customers, run algorithms for credit scoring and disburse loans at a faster pace. The company is currently operational in East-Delhi and plans to have 11 branches operating across North and Central India, targeting 1500 customers in the next 12 months.

Talking about the fund raise, Ashutosh Sharma, Founder, Ummeed says, “Families that have semi-formal or informal incomes and comprise the bottom-of-the-pyramid, remain largely under-served by housing finance companies and banks. This is especially true when the loan requirement falls below INR 10 lakhs, making them highly dependent on local money lenders. We want to change this by offering an easier, more reliable option for loans. We also realise that technology will give us the leverage to address needs of a large share of this low income segment. The funding from Lok and Duane Park will help us bolster our technology platform and accelerate our expansion plans.”

Since its inception in 2004, Lok Capital has consistently built an enviable track record of investments in diverse business models in financial inclusion. This includes small finance banks, affordable housing finance and MSME finance. Lok Capital has identified affordable housing finance as a crucial component of financial inclusion as it creates a stable and long-lasting asset for a family, apart from significantly improving their standard of living. Impetus in the form of new housing inventory and evolution of credit assessment methodologies has improved the viability and scalability of affordable housing finance companies. The final piece is access to capital, which is imperative for the growth of these companies. Lok Capital’s investment in Ummeed is the third investment in this sector, following earlier investments in Aptus and SEWA Grih Rin.

Announcing the investment in Ummeed, Vishal Mehta, Cofounder & Partner, Lok Advisory Services says, “While there is a large unaddressed market in affordable housing finance, to make a significant impact and build an efficient, scalable model, depth of reach is key. Ummeed’s approach to marketing with a hub-spoke strategy and a conscious focus to build a technology savvy company will enable this. Ummeed is backed by an extremely capable and credible founding team which straddles superior operating and capital raising experience. We are excited to partner with them. ”

Speaking about the investment in Ummeed, Anurag Bhargava of Duane Park Private Limited, said “Duane Park is excited about partnering with Ashutosh and his superb team, all of whom have extensive experience in affordable housing finance. The market is growing and dynamic, and Ummeed will emerge as a leader through its organic growth strategy and partnerships.”

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Lok Capital Fund Leads $3.5M Series A Funding in Ummeed Housing Finance

Lok Capital advised Growth Catalyst Partners (GCP) – the third fund from the India focused impact investor - today announced that it has led the Series A investment of $3.5 million in Ummeed, a Delhi-based Housing Finance company focused on affordable housing in North and Central India. This is the maiden investment from Lok’s third fund. Duane Park is a co-investor in this investment round. The institutional funding will fuel Ummeed’s expansion plans as well as boost deployment of technology towards achieving greater operating efficiency. Vishal Mehta, Cofounder & Partner, Lok Advisory Services and Anurag Bhargava of Duane Park will join the board of Ummeed. Mr. Alok Prasad, Ex-Mortgage Head at Citi Financials and Ex-CEO of Microfinance Industry Association (MFIN), will also join as a Non-Executive Board Member at Ummeed.

The potential of the Indian affordable housing finance segment is pegged at Rs. 8.8 trillion (~$135 billion), according to a Monitor-Deloitte study commissioned by World Bank and the National Housing Bank. However, the portfolio of existing affordable housing players is only Rs. 6,500 Crore (~$1 billion). As banks and large NBFCs focus towards the formal, higher income segment, an immense opportunity presents itself for startups like Ummeed to develop a sustainable business model in lending to the informal market.

Founded in January 2016 by Ashutosh Sharma, a seasoned banker with over 25 years of experience at Citi, HSBC and Bank of Montreal, Ummeed focuses on providing housing finance access to families with low, informal income. The company is backed by a team of ex Citi Bank professionals, who have solid foothold in commercial banking, credit and mortgage. Sachin Grover, the Chief Operating Officer, has over 20 years of mortgage experience at Citi Financials, IIFL and Magma Housing. The operating team consists of professionals with extensive small-ticket mortgage experience at AU Housing, Magma and Shubham.

While companies in the affordable housing space are largely traditional brick and mortar players, Ummeed aims to differentiate itself by leveraging technology to operate its business on ground. Its in-house technology team is building a robust technology platform for loan origination and loan management. Ummeed aims to go paperless, deploying tablets in all of its branches that can study the customers, run algorithms for credit scoring and disburse loans at a faster pace. The company is currently operational in East-Delhi and plans to have 11 branches operating across North and Central India, targeting 1500 customers in the next 12 months.

Talking about the fund raise, Ashutosh Sharma, Founder, Ummeed says, “Families that have semi-formal or informal incomes and comprise the bottom-of-the-pyramid, remain largely under-served by housing finance companies and banks. This is especially true when the loan requirement falls below INR 10 lakhs, making them highly dependent on local money lenders. We want to change this by offering an easier, more reliable option for loans. We also realise that technology will give us the leverage to address needs of a large share of this low income segment. The funding from Lok and Duane Park will help us bolster our technology platform and accelerate our expansion plans.”

Since its inception in 2004, Lok Capital has consistently built an enviable track record of investments in diverse business models in financial inclusion. This includes small finance banks, affordable housing finance and MSME finance. Lok Capital has identified affordable housing finance as a crucial component of financial inclusion as it creates a stable and long-lasting asset for a family, apart from significantly improving their standard of living. Impetus in the form of new housing inventory and evolution of credit assessment methodologies has improved the viability and scalability of affordable housing finance companies. The final piece is access to capital, which is imperative for the growth of these companies. Lok Capital’s investment in Ummeed is the third investment in this sector, following earlier investments in Aptus and SEWA Grih Rin.

Announcing the investment in Ummeed, Vishal Mehta, Cofounder & Partner, Lok Advisory Services says, “While there is a large unaddressed market in affordable housing finance, to make a significant impact and build an efficient, scalable model, depth of reach is key. Ummeed’s approach to marketing with a hub-spoke strategy and a conscious focus to build a technology savvy company will enable this. Ummeed is backed by an extremely capable and credible founding team which straddles superior operating and capital raising experience. We are excited to partner with them.”

Speaking about the investment in Ummeed, Anurag Bhargava of Duane Park Private Limited, said “Duane Park is excited about partnering with Ashutosh and his superb team, all of whom have extensive experience in affordable housing finance. The market is growing and dynamic, and Ummeed will emerge as a leader through its organic growth strategy and partnerships.”

- Share