Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Ummeed Housing Finance raises $5.6M in Series B funding from existing investors

Delhi-based affordable housing finance company, Ummeed Housing Finance has raised $5.6 million in Series B funding from existing investors Lok Capital Growth Fund (Lok’s third fund) and Duane Park.

The company plans to use the fresh round of funds to fuel its expansion plans to new locations in North and Central India, make investments in SMAC (Social, Mobile, Analytics and Cloud) technologies, and grow assets under management by six times in the next year.

Last October, the company raised its first institutional fund of $3.5 million from Lok and Duane Park.

Founded in January 2016 by Ashutosh Sharma, who spent 25 years at Citi, HSBC, and Bank of Montreal, Ummeed focuses on providing housing finance access to families with low and informal income. Ummeed is registered with National Housing Bank (NHB) under National Housing Bank Act, 1987

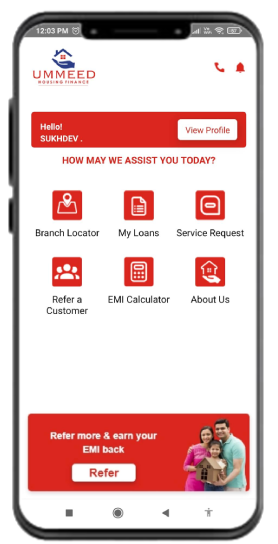

Ummeed has already invested in building a technology platform for loan origination and loan management. In the next phase of technology deployment, Ummeed aims to harness the power of SMAC. It targets to go paperless, deploying tablets in all of its branches that can study the customers, run algorithms for credit scoring, and disburse loans at a faster pace.

Talking about the latest fundraise, Sharma, Founder of Ummeed, said:

“The fresh round of investment comes at a time when Ummeed is ready for scale. We will strengthen our Fintech and move towards becoming a mobile platform. We aim to build scoring modules that can improve operational efficiencies, reduce turnaround time, and build robustness around the credit quality of the portfolio. We would like to thank Lok and Duane Park for their continued support as we gear up for our next stage of growth.”

According to a Monitor-Deloitte study commissioned by World Bank and the National Housing Bank, the potential of the Indian affordable housing finance segment is currently pegged at Rs 8.8 trillion (approximately $135 billion). Topped with this, the Govt of India’s policies like Pradhan Mantri Awas Yojna, promoting affordable housing, is expected to provide further impetus to the segment. This conducive environment gives an immense opportunity for a company like Ummeed to lend to the informal market and gain significant market share.

Announcing the follow-on investment, Vishal Mehta, Co-founder of Lok Capital, said:

“Both the approach to building the business and the proof points on the ground have reinforced our faith in the Ummeed team. We believe Ummeed will become a significant player in the affordable housing space in a short span of time, given the large market size, the founding team’s focused approach, strong underwriting capabilities, and the vision to leverage technology. We are excited about the growth prospects of the company and are happy to further our commitment in Ummeed.”

Ummeed is backed by a team of former Citi Bank professionals, who have experience in commercial banking, credit, and mortgage. Sachin Grover, the Chief Operating Officer, has over 20 years of mortgage experience at Citi Financials, IIFL, and Magma Housing. The operating team of Ummeed consists of professionals with small-ticket mortgage experience at companies like AU Housing, Magma, and Shubham. Bikash Sharma has come on board as Financial Controller with nine years of experience in fundraising, financial modelling, treasury, and finance functions. He has previously worked in Manappuram Finance and Encore Capital Group.

Over the last eight months, the company claimed to have grown exponentially with three branches in Delhi, Chandigarh, and Jaipur and has close to Rs 20 crore assets under management (AUM). Ummeed aims to expand to six new locations across North and Central India, and build AUM of Rs 120 crore by March 2018.

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Ummeed Housing Fin raises $5.6m from Lok Capital

Ummeed Housing Finance, a Delhi-based affordable housing finance provider, has raised $5.6 million in Series B funding from existing investors — Lok Capital Growth Fund and Duane Park. This follows the first institutional funding of $3.5 million in October, 2016.

In a statement issued here on Monday, the company said that the new investment will fuel the company’s expansion plans to new locations in north and central India. It would also be investing in digital technology and target growing its assets under management (AUM) by six times in the next year.

The home finance company was founded in January, 2016 by former Citibanker Ashutosh Sharma, who spent 25 years at Citi, HSBC and Bank of Montreal. The company is focused on home loans for families with low and informal income.

“The fresh round of investment comes at a time when Ummeed is ready for scale. We will strengthen our fintech and move toward becoming a mobile platform. We aim to build scoring modules that can improve operation efficiencies, reduce turnaround time & build robustness around the credit quality of the portfolio,” said Sharma.

“We believe Ummeed will become a significant player in the affordable housing space in a short span of time, given the large market size, the founding team’s focused approach, strong underwriting capabilities and the vision to leverage technology,” said Vishal Mehta, co-founder, Lok Capital.

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Umeed Housing Finance raises $5.6 mn from Lok Capital, Duane Park

Housing finance company, Ummeed Housing Finance on Monday said it has raised Series B funding of USD 5.6 million from existing investors Lok Capital Growth Fund and Duane Park

Housing finance company, Ummeed Housing Finance on Monday said it has raised Series B funding of USD 5.6 million from existing investors Lok Capital Growth Fund and Duane Park.

The company will utilise this money in expanding to new locations in North and Central India, improve technology and grow assets under management by six times in the next year.

The company last raised USD 3.5 million from Lok and Duane Park in October.

Founded in January 2016 by Ashutosh Sharma, who spent 25 years at Citi, HSBC and Bank of Montreal, Ummeed focuses on providing housing finance access to families with low and informal incomes.

The company currently has three branches in Delhi, Chandigarh and Jaipur and has close to Rs 20 crore assets under management.

In the next one year, Ummeed aims to expand to six new locations across North and Central India. It aims to build asset under management of Rs 120 crore by March 2018.

"The fresh round of investment comes at a time when Ummeed is ready for scale. We will strengthen our fintech and move towards becoming a mobile platform," said Ashutosh Sharma, founder, Ummeed.

According to a Monitor-Deloitte study commissioned by World Bank and the National Housing Bank, the potential of the Indian affordable housing finance segment is currently pegged at Rs 8.8 lakh crore.

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Impact investor Lok Capital deploys 60% of Fund III

Impact investor Lok Capital, which is looking to close its Fund III at $90-100 million in the next three to four months has already deployed about 60% of the capital raised so far in the first 18 months of the fund.

“So far about $50 million has been made in terms of commitments or deployments in new companies and follow-on investments,” said Vishal Mehta, co-founder at Lok Capital. Given the current rate of deployment, Lok Capital will start raising its next fund my the mid of next year as per Mehta.

The investment firm, which has already received commitments of $80 million from LPs for its third fund, is targeting a total of 14 to 15 investments from Fund III and will invest in five to seven more companies by the end of next year in areas such as financial services, agri-businesses and healthcare.

Some of the investments from the third fund this year include $5.6 million in Delhi-based affordable housing finance company Ummeed Housing Finance along with Duane Park and in the $10-million round of Chennai-based Diabetes Care provider Dr Mohan Diabetes Specialities Care. Also last year in November, Lok Capital along with Aavishkaar had invested Rs 45 crore in Jharkhand-based dairy brand Osam.

The fund attributes one of the reasons behind fast deployments to an increase in its investment ticket size.

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

India Digest: Ummeed, Sequretek raise funds; IIFL Wealth buys Altiore; Netlink sells exhibition biz

In the latest startup funding, Ummeed Housing Finance has raised $10 million in a Series C round of funding from global impact investor LGT Impact and Lok Capital. In the M&A space, IIFL Wealth Management has acquired Bengaluru-based fintech company Altiore Advisors while Netlink Solutions is selling its exhibition business to the Indian subsidiary of Messe Frankfurt Exhibition GmbH.

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Ummeed Housing Finance raises $10M; Brings LGT Impact on board

Ummeed will use a portion of the proceeds to further build its technology platform and complete the second phase of its mobility offering

Ummeed Housing Finance has raised $10 million (Rs 72 crore) in its latest round of funding, bringing on board global impact investor LGT Impact. Existing backer Lok Capital also participated in the investment round.

Post the closure of the latest round of equity financing, the Gurgaon-headquartered affordable housing finance company, which caters to the informal and low-income segment, will have raised an estimated Rs 135 crore in funding across three rounds.

“The incremental equity infusion as a result of the series C (funding) will allow us to enhance our borrowings from banks and the bond market, building a reasonable amount of leverage, which, in turn, will facilitate our growth in (assets under management),” Ashutosh Sharma, founder and managing director of Ummeed Housing Finance, told ET.

Ummeed will use a portion of the proceeds to further build its technology platform and complete the second phase of its mobility offering, he said.

LGT Impact is the impact investment arm of LGT, the family office of the princely house of Liechtenstein, one of the world’s largest privately owned private banking and asset management groups with AUM of about $150 billion as of March 2017.

Ummeed, which launched its operations two years ago, has an outstanding loan book of Rs 200 crore, and is targeting assets under management of Rs 350-400 crore by the end of this fiscal year.

Its latest fundraise comes about 16 months after the company secured Rs 36 crore in a funding led by Lok Capital and Duane Park. Unitus Capital acted as the financial adviser for the latest fundraising round.

Founded in 2016 by Sharma, who was previously with Citibank, Ummeed Housing Finance provides housing loans and loans against property ranging from Rs 3 lakh to Rs 25 lakh for tenures of 2-20 years.

The startup’s revenue model is two-fold—earning from monthly repayments by customers on the loans provided to them, as well as through fees from consumers undertaking term insurance covers.

“The affordable housing finance space in India has and continues to draw strong interest from private equity investors, given the sheer size and low penetration of this segment of the housing finance industry,” Sharma said. “News flows around well-priced potential IPOs by some of the early starters in the affordable housing space clearly demonstrates that it is possible to build out a large and profitable business here.”

- Share

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Swiss investor leads Series C funding round in Ummeed Housing Finance

Delhi-based Ummeed Housing Finance Pvt. Ltd has raised Rs 60 crore ($8.3 million) from Zurich-headquartered LGT Impact and Rs 5 crore ($690,000) from existing social-impact investor Lok Capital in a Series C round.

The funding will help Ummeed expand its presence, said a statement from Unitus Capital, the lender’s financial adviser on this deal.

Ummeed aims to expand its loan book from Rs 200 crore to over Rs 350 crore by the end of the current financial year, added the statement.

The lender was founded in January 2016 by Ashutosh Sharma, who had spent 25 years at Citibank, HSBC and Bank of Montreal. The company provides housing finance to families with low and informal income. It offers loans ranging from Rs 3 lakh to Rs 25 lakh for purchase of apartments, construction, improvement and extension of houses. It also makes loans against property.

Haryana, Rajasthan, Uttar Pradesh, and the National Capital Region are the key focus geographies of Ummeed.

The lender had last raised $5.6 million (Rs 36 crore) in a Series B round from existing investors Lok Capital and Duane Park in May 2017.

LGT Impact

Swiss investor LGT Impact invests in companies offering solutions to social and environmental challenges in growth markets.

LGT Impact is an investor in Aye Finance and Thirumeni Finance, which operates under the Varthana brand.

Earlier this year in February, it invested in Bengaluru-based ed-tech startup Imax Program.

Lok Capital

Lok Capital focuses on sectors such as financial services, financial inclusion, healthcare and agriculture.

In April, it participated in the Series B round of healthcare financing platform Affordplan.

Last year, it made a seed investment of $2 million (Rs 13 crore) in Mumbai-based online lending startup Mintifi.

Its other portfolio companies include Chennai-headquartered Dr Mohan’s Diabetes Specialities Centre and Ranchi-based dairy company HR Food Processing.

Lok Capital had raised around $87 million for two funds. It has a target corpus of around $100 million (Rs 650 crore) for the third fund, which had made its first close at $40.5 million in June 2016.

Recent deals in affordable housing

The affordable housing space has seen some activity ever since prime minister Narendra Modi launched the ‘Housing for All’ scheme in 2015 to provide housing facilities to everyone in urban areas by 2022.

Last month, International Finance Corporation (IFC), the private-sector investment arm of the World Bank, had given debt of around $75 million to L&T Housing Finance Ltd, a subsidiary of L&T Finance Holdings Ltd, according to an IFC disclosure.

In June, HomeKraft, the affordable and mid-income housing arm of Noida-based developer ATS Group, had sold a significant minority stake to HDFC Capital Affordable Real Estate Fund Ltd.

Earlier this year, IFC had received board approval to invest $41 million in projects of Delhi-based developer Ashiana Housing.

- Share