MSME Business Loan

MSME business loans allow your business the chance to grow and give it the competitive edge it needs to succeed in the modern world. For quick funds for business expansion, Ummeed Housing Finance offers small-size business loans up to Rs. 20 lakhs with repayment terms of up to 7 years. So, if you require financial aid for your business, you've come to the right place. Apply for a MSME business loan online now!

MSME Business Loan

- Loan against built up Self Occupied, residential and commercial properties.

- Loan for Self Employed borrowers (Exclusive Loans for Shopkeepers)

- Loan amount from 2 to 20 Lacs.

- Tenure up to 8 years.

- Borrower should have a bank account.

- Customer should be more than 25 years of age and not more than 65 years at the time of loan maturity.

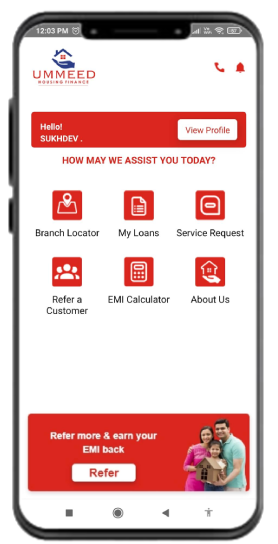

- Should be residing in a city where UMMEED HOUSING FINANCE has an office.

- Guarantor not mandatory.

- All the owners of the financed property and all individuals whose income has been considered for the loan have to be the co-applicants to the loan.

- Loans can be taken for the following end uses :

- Buying New Stock

- Working capital for existing business

- Buy new property, which is to be used for business

- Renovation of Existing shop

- Buying machinery for business

- Balance transfer of existing Business Loan

Features and Benefits

- MSME Business Loan amount from 2 lakhs to 20 lakhs.

- Tenure from 2 years to 7 years.

- Loan against no registered property

- Easy process and Approvals

- Short amount of loan with competitive rates

- Can be used for areas where no registered document is available

- Provide Money for running small businesses

Faq's

MSME Business Loan in Your City

Customer Stories

सोनू कुमार

Product:- MSME Business Loan | Loan Amount : Rs. 3,00,000/- | End Use:- Business Expansion

मेरा नाम सोनू हे। मैं चंडीगढ़ सेक्टर- 44 में स्टेशनरी की दुकान चलाता हूं, छात्रों की बढ़ती मांग को पूरा करने के लिए मैं अपनी दुकान में स्टेशनरी का स्टॉक बढ़ाना चाहता था और एक कंप्यूटर भी लगवाना चाहता था अपने बिज़नेस की इस ज़रूरत के लिए मुझे 3 लाख़ के लोन की ज़रुरत थी जब मैं लोन का आवेदन लेकर बैंक गया तो पता चला की कोई भी बैंक मुझे इतना कम रकम का लोन देने के लिए तैयार नहीं है और मैं साहूकारों के पास भी उनके भारी ब्याज दरों की वजह से नहीं जाना चाहता था । फिर एक दिन मुझे उम्मीद हाउसिंग फाइनेंस के एक अफसर से उनके छोटे बिज़नेस लोन के बारे में पता चला | उम्मीद के लोन अफसर ने मुझसे मेरे दस्तावेज़ लिए और केवल 7 दिनों में मुझे 3 लाख का लोन उचित ब्याज दर पर मिल गया | मेरी दुकान में नई स्टेशनरी और कंप्यूटर आने से ग्राहकों की संख्या भी बहुत बढ़ गयी है | मेरे व्यापार को बढ़ाने में मदद करने के लिए उम्मीद का बहुत धन्यवाद् करता हूं |

Customer Experience

मेरे व्यापार को बढ़ाने में मदद करने के लिए उम्मीद का बहुत धन्यवाद् करता हूं |

Customer Stories

महावीर प्रसाद मोदी

Product:- MSME Business Loan | Loan Amount : Rs. 3,00,000/- | End Use:- Machinery Purchase

मेरा नाम महावीर प्रसाद मोदी है| मैं बीकानेर शहर में कंप्यूटर टाइपिंग,प्रिंटिंग और फोटोकॉपी की दुकान चलता हूं | मेरी दुकान पर सभी सरकारी परीक्षाओ के आवेदन पत्र भी मिलते हैं | अपने ग्राहकों की जरूरतो को देखते हुए मैं अपनी दुकान में एक बड़ी मल्टी कलर फोटोकॉपी मशीन लगाना चाहता था मैं पहले अपने बिज़नेस की ज़रूरतो के लिए साहूकारों से महंगी ब्याज दर पर पैसा लेता था मगर इस बार मैंने उम्मीद हाउसिंग फाइनेंस के छोटे बिज़नेस लोन का विज्ञापन देखा और उनके ग्राहक सेवा नंबर पर संपर्क किया | उम्मीद के ग्राहक सेवा प्रतिनिधि ने मुझे उम्मीद के छोटे बिज़नेस लोन के बारे में बताया और मुझे लोन के लिए ज़रूरी दस्तावेजों की सूची दी | अगले ही दिन उम्मीद का लोन अफसर मेरे कागज़ात ले गया और मुझे 3 लाख का लोन 6 दिन में मिल गया | अब मुझे पता है की मेरे बिज़नेस कि किसी भी लोन की ज़रूरत को पूरा करने के लिए उम्मीद हाउसिंग फाइनेंस मेरे साथ है |

Customer Experience

अब मुझे पता है की मेरे बिज़नेस कि किसी भी लोन की ज़रूरत को पूरा करने के लिए उम्मीद हाउसिंग फाइनेंस मेरे साथ है |Customer Stories

Sanjeev Kumar

Product:- MSME Business Loan | Loan Amount : Rs. 3,48,000/- | End Use:- Shop purchase

मेरा नाम संजीव कुमार है। मैं यमुना नगर में पकोड़े की दुकान चलाता हूँ। मेरा व्यवसाय अच्छा चल रहा था और अब मैं एक मिठाई की दुकान खोलकर अपने व्यवसाय को बढ़ाना चाहता था, जिसके लिए मेरे पास कुछ पैसे थे, लेकिन वह एक नई दुकान खोलने के लिए पर्याप्त नहीं थे। मैं धन जुटाने के लिए कई बैंकों में पहुंचा, लेकिन अघोषित आय के कारण कोई भी बैंक मुझे लोन देने के लिए तैयार नहीं था, एक दिन मैंने अपनी दुकान के पास उम्मीद बैंक की प्रचार गतिविधि देखी। वहाँ एक अफसर से उनके छोटे बिज़नेस लोन के बारे में पता चला, केवल 8 दिनों में और बहुत कम दस्तावेजों के साथ मुझे दुकान खरीदने के लिए लोन देदिया | आज मैंने अपने और लोन के रूपए मिला करके एक अपनी नयी दुकान खोल ली है|

Customer Experience

जरुरत पर साथ देने के लिए उम्मीद हाउसिंग फाइनेंस को बहुत बहुत धन्यवाद |

Customer Stories

रामजी लाल (जनरल स्टोर)

Product:- MSME Business Loan | Loan Amount : Rs. 3,50,000/- | End Use:- Purchasing Stock

मेरा नाम रामजी लाल है। मैं आगरा में एक जनरल स्टोर चलाता हूं। लॉकडाउन के दौरान मेरी सारी बचत समाप्त हो गई और मेरी दुकान में रखे जाने वाले सभी सामान भी ख़राब हो गए थे| अब मेरी समझ में यह नहीं आ रहा था कि मैं अपने व्यवसाय और अपनी कमाई को फिर से कैसे शुरू करूँगा? फिर एक दिन मैंने अखबार में उम्मीद हाउसिंग फाइनेंस का विज्ञापन पत्र देखा, जिससे मुझे पता चला कि यह कंपनी कम से कम दस्तावेज़ों पर छोटे बिज़नेस लोन देती है। मैंने विज्ञापन पत्र पर दिए गए टोल फ्री नंबर पर कॉल किया और उनके एक अफसर ने मेरे दस्तावेज़ों को जल्द से जल्द पूरा करवाने में मेरी मदद की और मझे लोन देदिया|

Customer Experience

आज मैं बहुत खुश हूं कि मैंने अपने व्यवसाय को और बेहतर तरीके से फिर से शुरू कर लिया है| धन्यवाद उम्मीद हाउसिंग फाइनेंस ।

Business Loan

Ummeed Housing Finance offers quick and secured business loans Loan for Self Employed borrowers that will help strengthen the business and propel it to new heights. For the MSME sector, Ummeed offers MSME Business loans with an emphasis on business owners. We also offer small business loans to ensure that funding will never be an obstacle in your way of achieving more. Our products are made to fit your demands. Choose Ummeed Housing Finance if you require a quick business loan to fulfill your financial requirements. Apply for a business loan online now!

Business Loan

- Loan against built up residential and commercial properties.

- Loan for Self Employed borrowers

- Loan amount from 3 lakhs to 25 lakhs.

- Tenure from 2 years to 10 years.

- Borrower should have a bank account.

- Customer should be more than 25 years of age and not more than 65 years at the time of loan maturity.

- Should be residing in a city where UMMEED HOUSING FINANCE has an office.

- Guarantor not mandatory.

- All the owners of the financed property and all individuals whose income has been considered for the loan have to be the co-applicants to the loan.

- Loans can be taken for the following end uses :

- Buying New Stock

- Working capital for existing business

- Buy new property, which is to be used for business

- Renovation of Existing shop

- Buying machinery for business

- Balance transfer of existing Business Loan

Features and Benefits

- Business Loan amount from 3 lakhs up to 25 lakhs.

- Tenure from 2 years to 10 years.

- Loan for a long-term period against property

- Flexibility of using the loan amount (machinery or Stock)

- Helps in the expansion of your business

Faq's

Business Loan in Your City

Customer Stories

Mr. Manoj Tomar

Product:- Business Loan | Loan Amount : Rs. 8,00,000/- | End Use:- Business Expansion

With exceptional service standard & speed, Ummeed disbursed my loan in 7 days, from the date of my first meeting them. I never thought, getting a loan can be so easy & smooth with my minimum documents. I thank Ummeed to help me realize my dream of expanding my business

Customer Experience

I thank Ummeed for helping me expand my business. I was pleasantly surprised to note how flexible their service offering was.

Customer Stories

संजय गुप्ता

Product:- Business Loan | Loan Amount : Rs. 7,00,000/- | End Use:- Stock Purchase

मेरा नाम संजय है और मैं लक्ष्मी नगर (दिल्ली) में महिलाओं के जूते-चप्पलों की दुकान चलाता हूँ ।मेरा व्यवसाय अच्छा चल रहा था और मैं अपनी दुकान में पुरुषों और बच्चों के जूते-चप्पलों का भी कलेक्शन रखकर अपना कारोबार को और बढ़ाना चाहता था मैंने नया स्टॉक खरीदने के लिए कई बैंकों से ऋण के लिए संपर्क किया पर मेरे ज्यादातर लेनदेन नकद में होने की वजह से कोई भी बैंक मुझे ऋण देने को तैयार नहीं था मैं परेशान था की अब अपने व्यवसाय को कैसे बढ़ाऊंगा, तभी उम्मीद के लोन अधिकारी हमारे बाजार में आए और उन्होंने मुझे बिज़नेस लोन के बारे में बताया | उन्होंने मुझे बताया की कम से कम दस्तावेज़ों के साथ, मेरी आय और सम्पति के आधार पर मुझे बिज़नेस लोन मिल जायेगा | देखते ही देखते मुझे 8 दिनों में मुझे लोन का पैसा भी मिल गया | मेरी छोटी सी जूते चप्पल की दुकान अब फॅमिली फुटवियर शोरूम बन गया है|

Customer Experience

मेरी छोटी सी जूते चप्पल की दुकान अब फॅमिली फुटवियर शोरूम बन गया है|

Customer Stories

रमेश सिंह

Product:- Business Loan | Loan Amount : Rs. 10,00,000/- | End Use:- Machinery Purchase

मेरा नाम रमेश है और भिवाड़ी में मेरी बॉल बेअरिंग बनाने की छोटी से फैक्ट्री है| मार्किट में बॉल बेअरिंग की बढ़ती डिमांड को देखते हुए हम अपनी फैक्ट्री में एक और मशीन लगाना चाहते थे हमारा बिज़नेस रजिस्टर्ड न होने के कारण , मशीन खरीदने के लिए कोई भी बैंक लोन देने को तैयार नहीं हुआ | एक दिन उम्मीद हॉउसिंग फाइनेंस की टीम हमारी फैक्ट्री के पास आई और उनके लोन अफसर ने बताया की हमे हमारी आमदनी और प्रॉपर्टी के आधार पर बिज़नेस लोन मिल सकता | इस जानकारी के बाद हमने अपने कागज़ात उनके लोन अफसर को दिए और उम्मीद ने मेरा लोन मात्र 5 दिनों में स्वीकृत कर के मुझे मशीन खरीदने के लिए पैसा दे दिया |

Customer Experience

उम्मीद ने मेरा लोन मात्र 5 दिनों में स्वीकृत कर के मुझे मशीन खरीदने के लिए पैसा दे दिया |Customer Stories

Manish Jain (Jeweler)

Product:- Business Loan | Loan Amount : Rs. 35,20,681/- | End Use:- Working Capital

My name is Manish Jain & I run a gems & Jewellery shop in Laxmi Nagar, Delhi. My shop was closed for almost 2 months, as part of nation-wide lockdown due to the Corona pandemic and my business income dried up. I was running my household and paying my loan EMI’s using my savings, but my financial condition was getting worse by the day. I got a call from Ummeed Housing finance, my current lender and they told me that on the basis of my good track record they were ready to offer me a Top up loan of Rs. 3 lakhs to help restart my business operations. As soon I gave them a go ahead, the loan amount was credited to my bank A/C within 3 days.

Customer Experience

My shop has opened since last month, this loan helped in restarting my business. I am extremely thankful to Ummeed for helping me in my time of need.

Customer Stories

Mohd. Zahid Azmi (Teacher)

Product:- Business Loan | Loan Amount : Rs. 35,00,000/- | End Use:- Purchase of Machinery

My name is Zahid Azmi and I run a coaching center in Laxmi Nagar. The Going was smooth, when the world changed due to the Corona Pandemic and everything turned upside down. A majority of my students came from outstation locations and most of them moved back to their hometown as the coaching centre was closed. My business expenses were fixed due to salaries to the staff/Office rent and I was finding it difficult to pay my monthly loan EMI. During this time the Govt. declared a Moratorium scheme and to learn about it and avail of this facility, I called up Ummeed’s customer service team. The customer service team detailed for me all the positives and negatives of the scheme and informed me about the additional interest that I would need to pay if I availed the moratorium, Given my tight cash flows I opted for moratorium after balancing the pros & cons. Since then I have restarted my coaching online and business cash flow has resumed and I can now pay my regular EMI’s.

Customer Experience

I am very grateful to Ummeed Housing Finance for the help they provided to me during these difficult time, which helped focus my energy to restart my business.

Loan Against Property

A loan against property is a secured loan that offers Finance and has a flexible repayment period. Ummeed housing is among the reputed NBFCs providing finance against property where you can get a Loan Against Property while also taking care of your financial needs without giving up ownership or possession of the property. So, if you require financial aid and want to learn more about Loan Against Property, and the many advantages, and benefits of LAP, you've come to the right place. Apply for a loan against property online now!

Loan Against Property

- Loan against built up residential and commercial properties.

- Loan for Salaried & Self Employed borrowers

- Loan amount from 3 lakhs to 25 lakhs.

- Tenure from 2 years to 7 years.

- Borrower should have a bank account.

- Customer should be more than 25 years of age and not more than 65 years at the time of loan maturity.

- Should be residing in a city where UMMEED HOUSING FINANCE has an office.

- Guarantor not mandatory.

- All the owners of the financed property and all individuals whose income has been considered for the loan have to be the co-applicants to the loan.

- Loans can be taken for the following end uses :

- Purchase/Acquisition/Renovation of property.

- Higher Education of children.

- Medical expenses of family.

- Travel Purpose.

- Balance Transfer of existing Loan against Property.

- Any other lawful end use.

Features and Benefits

- Loan amount from 3 lakhs up to 25 lakhs.

- Tenure from 2 years to 7 years.

- Tax Benefits on LAP Loan.

- Manage huge expenses at an affordable rate.

- Few documents required.

- Fast Sanction and Approval.

- You can use funds for personal use.

Faq's

Loan Against Property in Your City

Customer Stories

Mr. Harvinder Singh

Product:- Loan Against Property | Loan Amount : Rs. 10,00,000/- | End Use:- Shop Purchase

Harvinder is a canter driver and owns a small dairy business. He wanted to purchase a nearby shop which was being sold at a very nominal price that can be let out on rent to provide him with additional income. To buy this shop he wanted to avail a loan facility and was denied from multiple places because of his cash earnings. He approached Ummeed through one of Ummeed’s Loan officer and within 10 business days he was provided with a Rs 10 Lacs loan for shop purchase.

Customer Experience

Thank You Ummeed for making my dream come true, wish you all success in future.

Customer Stories

तंवर सिंह

Product:- Loan Against Property | Loan Amount : Rs. 4,50,000/- | End Use:- Shop Renovation

मेरा नाम तंवर सिंह है और मेरी सांगनेर (जयपुर) में एक किराने की दुकान है। जब भी वव्यसाय के लिए पैसों की जरूरत होती थी तो स्थानीय साहूकारों से लोन लेता था। कुछ दिन पहले उम्मीद के लोन अफसर हमारी मार्केट में आए और बिज़नेस लोन के बारे में बताया, जिसका ब्याज दर साहूकार के ब्याज दर से बहोत काम था। इस बार जब अपनी दुकान का नवीनीकरण करने के लिए और स्टॉक बढ़ाने के लिए सोचा तो उम्मीद हाउसिंग फाइनेंस से संपर्क किया, और देखते ही देखते हमें सात - आठ दिनों में हमारी प्रॉपर्टी और आय के आधार पर बिज़नेस लोन मिल गया।

Customer Experience

अब मैं शान से कह सकता हूँ की मेरी दुकान सबसे पुरानी ही नहीं बल्कि सबसे बढ़िया भी है।

Customer Stories

सोना देवी (इलेक्ट्रॉनिक स्टोर ओनर)

Product:- Loan Against Property | Loan Amount : Rs. 20,00,000 /- | End Use:- Commercial Property Purchase

मेरा नाम सोना है और मैं अपने पति के साथ सोनीपत में एक इलेक्ट्रॉनिक्स आइटम्स की दुकान चलाती हूं | हमारा काम अच्छा चल रहा था और हम अपने बिज़नेस को बढ़ाने के लिए अपनी दुकान के पास वाली दुकान भी खरीदना चाहते थे | हमने आज तक कोई लोन नहीं लिया था जिसके कारण कोई भी बैंक हमे दुकान खरीदने के लिए लोन नहीं दे रहा था और मैं साहूकारों के पास भी उनके भारी ब्याज दरों की वजह से नहीं जाना चाहती थी | एक दिन उम्मीद हॉउसिंग फाइनेंस की टीम हमारी मार्किट में आयी और उनके लोन अफसर ने बताया की हमे हमारी आमदनी और दुकान की कीमत के आधार पर नयी दुकान खरीदने के लिए लोन मिल जायेगा | इस जानकारी के बाद हमने अपने कागज़ात उनके लोन अफसर को दिए और उम्मीद ने मात्र 8 दिनों में हमारा लोन स्वीकृत कर दिया |

Customer Experience

आज हमारी दुकान मार्किट की सबसे अच्छी और बड़ी दुकानों में से एक हैं | धन्यवाद् उम्मीद, आपने सही समय पर साथ दे कर हमारे बिज़नेस को बढ़ाने में मदद की |

Investors

Ummeed Housing Finance Private Limited (Ummeed) is a housing finance company registered with National Housing Bank (NHB) under National Housing Bank Act, 1987.

Norwest

Norwest is a preeminent, multi-stage investment firm with a unique perspective on what it takes to build large businesses through varied economic cycles. The firm has invested in over 600 companies across sectors during its history of 60+ years. With offices in Palo Alto, San Francisco, India, and Israel, we offer a global footprint, a qualified team, and a rare background that enables us to offer our portfolio companies high-level, long-term collaboration. Our experience makes us realistic about how businesses evolve, and we advise our portfolio companies at all phases of growth, from start-up through IPO or acquisition.

Norwest has one of the best track records amongst Private Equity funds in India, being in the top quartile in terms of performance and exits. In India, the fund has invested approximately USD 1.2 bn in 45+ companies in the last 12+ years across financial services (banks, SME finance companies, exchanges, etc.) healthcare, consumer, internet, technology, and infrastructure sector. Some of the prominent investments in India include Kotak Mahindra Bank, IndusInd Bank, RBL Bank, Five Star Business Finance, Shriram City Union Finance, Cholamandalam Finance, Ess Kay FinCorp, National Stock Exchange, Thyrocare, Swiggy, Pepperfry, Xpressbees, etc. We are long term investors, with an average investment horizon of 5 - 7 years.

Norwest has invested in some of the best, well governed financial services companies in India. Norwest has backed strong and dynamic management teams through time and has helped create significant economic and social value for all stakeholders, including the employees, shareholders along with generating significant employment and income generating opportunities for the average Indian customer.

Morgan Stanley

Morgan Stanley Private Equity Asia (“MSPEA”) is one of the leading private equity investors in Asia- Pacific, managing third party money funds, having invested in the region for over 20 years. MSPEA invests primarily in highly structured minority investments and control buyouts in growth-oriented companies. The experienced investment team is led by senior professionals with extensive industry relationships, in-depth market knowledge and the ability to apply international investment principles within each local context.

MSPEA has offices in Hong Kong, Beijing, Shanghai, Seoul, Mumbai, Bangkok and New York, and leverages the brand and global network of Morgan Stanley.

LGT Impact

LGT is the family office of the Princely House of Liechtenstein – the world’s largest privately-owned Private Banking and Asset Management group with USD 149.7 billion AUM as of March 2017. LGT has around 3,000 employees in more than twenty locations in Europe, Asia, the Americas and the Middle East. LGT Impact is the impact investing arm of LGT. Other funds under the LGT Group includes LGT Venture Philanthropy. LGT Impact, founded in 2007, is a private equity impact investor targeting both attractive financial returns and measurable, positive societal impact across education, health, agriculture, energy and IT, across Latin America, East Africa and India. The fund invests growth capital in purpose-driven companies with scalable business models which provide underserved people with access to affordable products, services, livelihood opportunities.

CX Partners

CX Partners was founded by Ajay Relan in 2009. Prior to that Ajay Relan led the charge at Citi Venture Capital International from its inception in 1995. CX Partners operates as a private equity group specializing in making growth equity investments. The fund strategy is to partner with owners and managers of exceptional, innovative businesses and help them build further upon these strengths. The typical investment size of the fund is approx. 10-20 USD million. CX Partners have approx. $625 MM fund under advisory with over 16+ portfolio companies.

Why ummeed

UMMEED HOUSING FINANCE Private Limited is a housing finance company registered with National Housing Bank (NHB) as a housing finance company under National Housing Bank Act, 1987.

Loan without formal income documents

At Ummeed Housing Finance Pvt. Ltd. we have Tailor-made our credit approach to better serve our target segment:

- Focus on assessing borrower’s income from all sources

- Use of in-house industry grids to benchmark applicant income

- Visit to borrower’s current residence, office and property mandatory

Quick approval and disbursement

Quick turnaround & timely delivery are the key tenants which drives us at Ummeed. Our first & foremost aim is to ensure that we provide a GO - NO GO within first 3 days and a financial approval within 5 days of login to the customer. We handhold the customer through out the loan process and ensure that all financially approved cases are disbursed within 3-5 days subject to availability of clear & marketable property documents. Turn around time is measured at each stage of the approval & disbursal process, so that there are no gaps in providing fast decisioning & quick turnaround. As a fintech housing finance company, technology remain at the core to enhance speed & provide timely decisioning to our customers. Our fast decisioning & disbursement process are the key differentiators.

Friendly Customer Service

We at Ummeed believe in providing best in class service experience to all our customers. We maintain complete transparency, in providing information to the customer. Our website provides information regarding the product & services along with all customer related important policies like “MITC- Most Important Terms & conditions”, Grievance Redressal & KYC. Once a customer walk in to any of our branches, he is provided with pamphlet’s with information on Fixed vs Floating rate of interest, information on disbursal cycle (detailing the various stages of construction & the percentage of loan amount that can be released at each of these stages) of a Plot Purchase plus construction loan, Self-Constructaion loan & Home extension loan. In case of any query, the customer can walk in to any of our branches or connect with our central customer service team (on Toll free no.- 18002 126 127 or mail at Customerservice@ummeedhfc.com), all these customers are provided with a customer service request number and depending upon the kind of request the team provides solutions within a pre approved turn around time.

Ummeed In News

This is Ummeed Housing Finance Pvt. Ltd.’s Media Centre, here you can have a glimpse of our corporate and brand announcements. You can also access our press releases, media reports, interviews and articles across print, online and electronic channels.

Ummeed Housing Fin Raises $10 m; LGT Impact on Board

Ummeed Housing Finance has raised $10 million (₹72 crore) in its latest round of funding, bringing on board global impact investor LGT Impact. Existing backer Lok Capital also participated in the investment round.

Post the closure of the latest round of equity financing, the Gurgaon-headquartered affordable housing finance company, which caters to the informal and low-income segment, will have raised an estimated ₹135 crore in funding across three rounds.

“The incremental equity infusion as a result of the series C (funding) will allow us to enhance our borrowings from banks and the bond market, building a reasonable amount of leverage, which, in turn, will facilitate our growth in (assets under management),” Ashutosh Sharma, managing director of Ummeed Housing Finance, told ET.

Ummeed will use a portion of the proceeds to further build its technology platform and complete the second phase of its mobility offering, he said.

LGT Impact is the impact investment arm of LGT, the family office of the princely house of Liechtenstein, one of the world’s largest privately owned private banking and asset management groups with AUM of about $150 billion as of March 2017.

Ummeed, founded in 2016 by ex-Citibanker Sharma, provides housing loans and loans against property ranging from ₹3 lakh to ₹25 lakh for tenures of 2-20 years. The company has an outstanding loan book of ₹200 crore, and is targeting assets under management of ₹350-400 crore by the end of this fiscal year.

Its revenue model is twofold—earnings from monthly repayments by customers on the loans provided to them, as well as through fees from consumers taking term insurance covers.

Ummeed’s latest fundraise comes about 16 months after the company secured ₹36 crore in a funding led by Lok Capital and Duane Park.

Unitus Capital acted as the financial adviser for the latest fundraising round.

“The affordable housing finance space in India has and continues to draw strong interest from private equity investors, given the sheer size and low penetration of this segment of the housing finance industry,” Sharma said. “News flows around well-priced potential IPOs by some of the early starters in the affordable housing space clearly demonstrates that it is possible to build out a large and profitable business here.”

- Share